Urban India’s unbranded boom

In urban India, inflation and increased online visibility have played a major role in driving consumers towards unbranded items in everyday categories like rice, flour, spices, oils, and household cleaners. According to data from Kantar, unbranded products recorded 8.4 per cent volume growth in urban areas in FY25, far outpacing the 2.3 per cent growth in rural markets.

“Currently, about 26 per cent of the FMCG volumes come from the unbranded segment in urban India… they are strong in categories like atta, rice, spices, edible oils, and floor cleaners. Price plays a big role in picking up unbranded products in segments like floor cleaners, and inflation likely nudged more metro shoppers to shift to unbranded goods. However, unbranded doesn’t always mean it is cheap. In categories such as coffee, while unbranded is relatively a smaller portion, people go for unbranded for its taste and aroma,” said Manoj Menon, director, commercial at Kantar Worldpanel, South Asia, in a statement to TOI.

Volume growth for 22 listed FMCG companies stood at just 2.1 per cent in urban areas, reflecting how traditional players are losing ground in cities, even as rural demand rises.

Rural India’s trust in legacy brands

On the other hand, branded FMCG companies like Nestlé, Dabur, HUL, and ITC are continuing to gain rural market share. Distribution strength and deep penetration have helped legacy firms grow volumes by 5.1 per cent in rural India, according to TOI, citing NielsenIQ data for the March quarter.

“The rural consumers across all income segments are exhibiting a marked propensity towards spending on premium, high-quality products which are backed by strong brand values, even at a high price,” said Mohit Malhotra, CEO of Dabur.

Dabur has been expanding its rural footprint with affordable, rural-specific packaging. Similarly, Britannia and ITC have been tailoring rural outreach through wider distribution and product innovations, even as they test urban launches through quick commerce and digital-first channels.

New-age brands tap urban appetite

City shoppers, driven by access to mobile phones and a culture of online product discovery, are fuelling the rise of digital-first brands.

“More prominently in urban India, consumers are trading up across categories. They are growing out of FMCG brands of the past. Product discovery is happening online, and many of the new-age brands are not yet available in general trade,” TOI quoted Mayank Rastogi, markets leader, strategy and transactions practice at EY India, as saying.

“D2C new-age brands with their fail-fast DNA are quick to change product formulations, packaging,” Rastogi added.

Brands like Slurrp Farm, which focused early on millet-based products, have gained momentum from online demand. “Quick commerce now contributes 35–40 per cent of total sales,” said co-founders Meghana Narayan and Shauravi Malik to TOI.

Big FMCG’s twin strategy

Large FMCG players are now deploying dual strategies: One for digital-savvy urban shoppers and another for rural buyers.

“While quick commerce is an emerging channel (in urban areas), it addresses more impulse and top-up needs,” said Angshu Mallick, MD & CEO at AWL Agri Business.

Britannia is launching digital-first products to attract metro consumers, while ITC is placing early-stage urban innovations through quick commerce platforms. “A lot of ITC’s new products in urban areas today are quick commerce first,” said Sandeep Sule, divisional chief executive, trade marketing and distribution, FMCG at ITC.

Battle of mass-produced versus artisanal products

In the modern marketplace, consumers are faced with a stark choice: do they purchase affordable, readily available fast-moving consumer goods (FMCGs), or do they seek out handmade, small-batch, often costlier artisanal alternatives produced by small businesses or farmers? Both categories have their merits and pitfalls, reflecting broader tensions between scale, efficiency, sustainability, and ethical consumption.

The advantages of massproduced branded items include affordability and accessibility. Automated systems, economies of scale, and bulk sourcing mean that branded FMCGs are cheaper to produce and, consequently, to purchase. A packet of mass-produced biscuits or a bottle of shampoo is available in even the remotest corners of India, Africa, or Latin America.

There is also consistency in quality with stringent protocols and regulatory oversight. Consumers know what to expect from a branded product — every time, everywhere. These products also have a longer self life due to advanced packaging technologies used. This makes them convenient for large retailers and essential in regions lacking cold storage or stable supply chains.

Branded FMCG products also employ millions globally and thus help in job creation. They often invest in large-scale infrastructure, contributing to economic growth.

But there are some disadvantages as well, of mass produced items. These include high carbon footprint, long supply chains, plastic packaging, pollution, deforestation, and excessive resource consumption.

The dominance of mass-produced goods can also push traditional foods, local ingredients, and farming practices to the margins. Traditional knowledge systems may erode under the weight of uniform, globalised consumption.

On the other end of the spectrum are products made by local artisans, farmers, and small businesses — often using traditional techniques and locally sourced materials. These include handmade soaps, organic jams, bamboo toothbrushes, handwoven fabrics, and single-origin chocolates.

Their advantages include support for local economies. Buying from small businesses directly supports farmers, craftspersons, and entrepreneurs. Income stays within communities, fostering local resilience and reducing dependence on global supply chains.

Many artisanal producers prioritise organic, seasonal, and sustainable practices. Small-batch production often uses less energy and minimal or biodegradable packaging, helping the environment.

Artisanal goods are often rooted in tradition — recipes handed down generations, weaving patterns specific to a region, or organic techniques honed by practice. They help preserve cultural identity in a homogenised global world.

Also, traceability is easier in a smaller setup. Consumers can know where their food or product came from, how it was made, and who made it — something large brands struggle to offer.

At the same time, artisnal products are high priced and have limited availability. Handmade goods take time, and small-scale producers cannot compete with factory prices. Products may not be available year-round or across geographies, limiting their reach.

There is also the issue of inconsistency of quality and regulation gaps. Without standardised equipment or rigorous quality checks, artisanal products can vary widely. In some cases, lack of regulation — especially for consumables — may pose health risks.

Small producers often struggle with scaling up. Supply chain management, logistics, marketing, and digital presence require skills and capital they may lack, limiting business growth. Artisanal products often cater to an urban, elite audience willing to pay a premium. This limits their potential impact in mass markets where affordability is paramount.

o Organic grains, ghee, jaggery, cold-pressed oils, and superfoods.

o Run by two farmer brothers, they focus on regenerative agriculture.

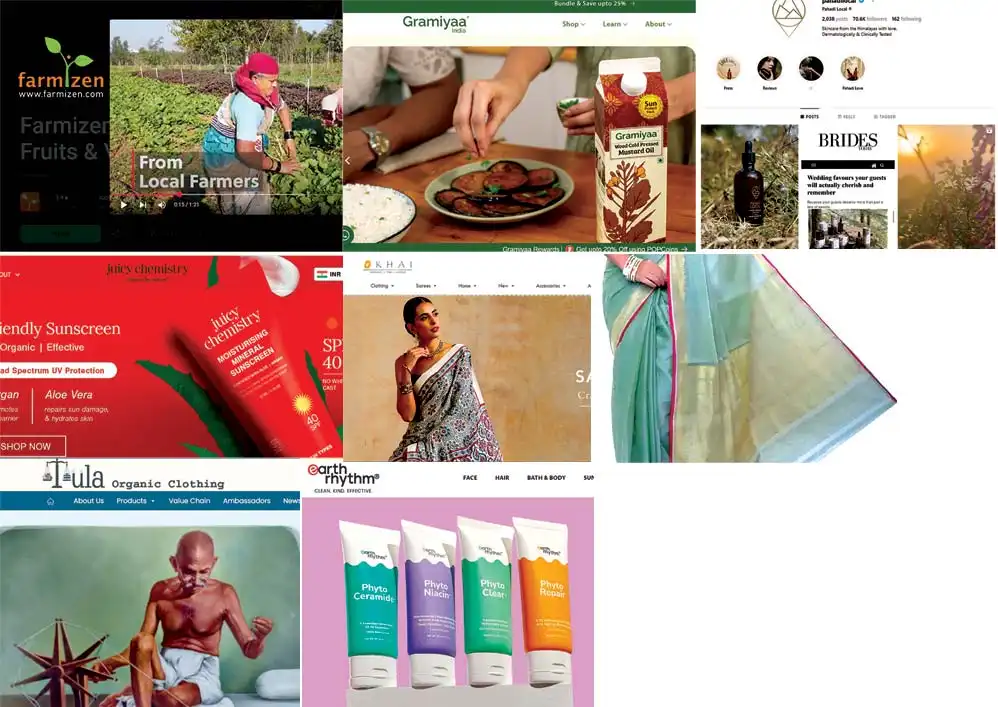

Farmizen

o Connects consumers directly with farmers for pesticide-free fruits, vegetables, pulses, and rice.

o Works on a farm-to-fork model with local, small-scale growers.

Original Indian Table

o Sells heirloom varieties of grains, pulses, spices, and pickles sourced from small farmers.

Gramiyaa

o Cold-pressed oils made using traditional wooden mills (chekku) from Tamil Nadu.

o No chemical processing or industrial refining.

TBOF (The Better Option Company)

o Offers traditionally grown millets, flours, and organic groceries sourced from tribal and marginal farmers.

o

Pahadi Local

o Wild apricot oils, Himalayan salts, and other wellness products sourced from the hills of Uttarakhand and Himachal.

Juicy Chemistry

o Small-batch certified organic skincare brand from Coimbatore.

o No synthetics or industrial chemicals.

Earth Rhythm

o Offers sustainable skin and haircare with a strong focus on zero-waste packaging.

Sadhev

o Ayurvedic beauty and wellness brand using traditional recipes with ingredients sourced from its own farms.

Vilvah Store

• Goat milk soaps, natural shampoos, and moisturizers made from farm-fresh and organic ingredients.

Okhai

• Clothing and home décor handmade by rural women artisans across India.

• Supported by Tata Chemicals Society for Rural Development.

Tula

• Completely handspun, handwoven organic cotton clothes made by rural artisans using rainfed cotton.

Kadambari

• Natural dye handlooms, khadi wear, and fabric-based lifestyle products sourced from Gujarat and Rajasthan.