Blitz Bureau

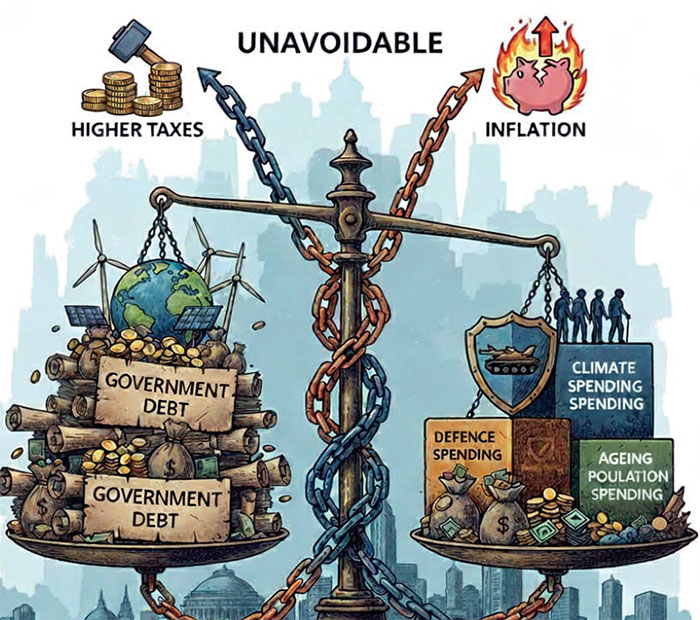

NEW DELHI: Government borrowing is unsustainable in the United States and much of Europe. There is also huge pressure to increase spending on climate, defence and ageing populations. Some mixture of higher taxes and inflation will ultimately be unavoidable, according to a Reuters analysis.

Global public debt as a percentage of output has been rising almost without a break since the mid-1970s. It will reach over 100 per cent of GDP by 2030, the highest level since World War Two, according to a forecast by the International Monetary Fund.

The problem is that governments are spending more than they are raising in taxes. Borrowing can only be sustainable if it is stable or falling as a percentage of gross domestic product. But that is only true if the annual budget deficit as a proportion of output is equal or less than nominal growth – an economy’s growth rate before adjusting for inflation.

Among the Group of Seven rich countries, the United States, France and the United Kingdom have the biggest problems. Their governments’ deficits, are forecast to be 7.4 per cent, 5.4 per cent and 4.3 per cent of GDP this year respectively, according to the IMF.

Meanwhile, their economies’ sustainable nominal growth rates are probably no more than 4 per cent, assuming both growth and inflation of 2 per cent. With debt, at 121 per cent, 113 per cent and 101 per cent of GDP, respectively, in 2024, something will have to change.

The other G7 countries’ debts are not on an upward path because their annual deficits are more or less under control. But Japan’s debt at 237 per cent of GDP and Italy’s at 135 per cent are uncomfortably high. Only Germany and Canada are in reasonable shape.

Ways to cut debt

An unsustainable debt load does not necessarily lead to a financial crisis. Rich countries typically have a lot of rope with which to hang themselves. This is especially true of countries which print their own currencies, such as the United States, the United Kingdom and Japan. It is less so of France and Italy, which must live by the monetary policy set by the European Central Bank.

But even if the day of reckoning is not round the corner, borrowing cannot rise forever. The problem is that there are few easy ways to bring it under control.

The best option is to increase growth. But unless artificial intelligence provides a miraculous boost to their economies, rich countries seem more likely to slow down in the coming years – not least because US President Donald Trump is undermining the world trading system with his tariffs.

Another option is to cut government spending. But there is massive public resistance to this. Just look at how France is unwilling to put up the age at which its citizens receive pensions.

In fact, “structural headwinds” could boost public spending by around 3 per cent, of GDP in coming years, according to Erik Nielsen, senior advisor at Independent Economics. The biggest items are ageing populations which push up pension and healthcare costs, defence spending, climate-related outlays, and infrastructure.

Yet another way to control mounting debt is “financial repression” – policies that artificially suppress the interest rate that savers get for funding the government. But this is only possible if a country restricts cross-border capital flows.

This is not possible for countries such as France that share the single currency. It also only works if a country has a current account surplus. That is not the case for the United States and Britain, which export less than they import and rely on foreign capital to fund themselves.

Defaulting on debt is another way to bring it down. But that is not a serious option for any G7 country – although there is always a risk that a game of chicken between the White House and Congress could result in Washington missing a debt payment by accident.

That leaves two other ways to stabilise borrowing levels: higher taxes and inflation, which itself is like a silent tax. Both are extremely unpopular. But the United States, Britain and France will ultimately be driven to some mixture of these choices.

Mix and match

Inflation is, in many ways, the path of least resistance. Raising taxes requires controversial debates in parliaments. Higher prices normally just creep up on the voters.

That said, rich countries have independent central banks tasked with keeping inflation low. So governments would first have to bully these financial guardians to do their bidding.

Trump is already trying to do this, attacking Federal Reserve Chair Jerome Powell for being too slow to cut interest rates and attempting to fire Governor Lisa Cook. But it is unclear that he will get his way.

The Bank of England is also vulnerable to strong-arming by politicians. The current government is unlikely to do this. But all bets will be off if Reform, the right-wing party led by Nigel Farage which is leading in the opinion polls, wins the next general election due by 2029.

On the other hand, inflation would not be a get-out-of-jail card in the UK. This is partly because a quarter of government debt is inflation-linked, meaning the interest rate and the principal go up when prices rise. What’s more, investors might demand higher interest rates for buying bonds if they thought inflation was on the horizon – meaning debt ratios might not fall at all.

Meanwhile, the ECB seems least likely to give up its inflation-fighting mandate as a result of political pressure. That is set out in a treaty. Even a coalition of countries would not be able to overturn that.

France and other euro zone countries with unsustainable debt loads are therefore most likely to end up raising taxes. That may mean rolling political crises until a leader emerges who is able to persuade the people that it is necessary to drink unpleasant medicine.

There may be one silver lining to higher taxes. If euro zone countries take that route to fiscal sustainability while the United States resorts to inflation, the euro is likely to outperform the dollar. Even so, the world’s rich countries face a set of unpleasant choices.