Blitz Bureau

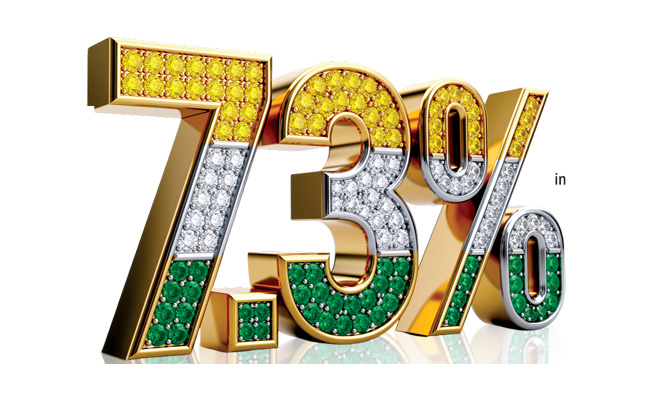

NEW DELHI: The International Monetary Fund’s (IMF) decision to raise India’s growth forecast for the current financial year to 7.3 per cent offers timely validation of the economy’s underlying momentum, even as it underscores the limits of a post-pandemic, investment-led rebound.

In its January 2026 update of the World Economic Outlook, the IMF revised its estimate for India sharply upward from the 6.6 per cent projected earlier, pointing to stronger-than-expected performance in the third quarter and what it described as “strong momentum” heading into the fourth.

“In India, growth is revised upward by 0.7 percentage point to 7.3 per cent for 2025 [FY 2025-26], reflecting the better-than-expected outturn in the third quarter of the year and strong momentum in the fourth quarter,” the IMF said.

IMF’s upward revision of the growth estimate places the Fund broadly in line with the Indian Government’s own projection of 7.4 per cent for the the current year, reinforcing the view that India remains the fastest-growing major economy in a slowing global landscape

The new estimate places the Fund broadly in line with the Indian Government’s own projection of 7.4 per cent for the year, reinforcing the view that India remains the fastest-growing major economy in a slowing global landscape.

Economists say the revision reflects a confluence of factors rather than a single driver. “What the IMF is acknowledging is that India’s growth impulse has been more broad-based than initially assumed,” said Pronab Sen, former Chief Statistician of India. “Public capital expenditure, resilient consumption in urban areas, and steady credit growth have together provided a cushion against global uncertainties.”

High-frequency indicators over recent months have pointed to robust activity in construction, manufacturing and services, supported by sustained Government spending on infrastructure and an improving private investment cycle.

Capacity utilisation in several manufacturing segments has edged higher, while bank credit growth has remained in double digits, especially for industry and retail borrowers.

At the same time, the IMF has been careful to temper expectations beyond the current year. Growth is projected to moderate to 6.4 per cent in 2026 and 2027, as what the Fund calls “cyclical and temporary factors” begin to fade.

This, analysts argue, is a reminder that India’s near-term performance is benefiting from favourable base effects, front-loaded public spending, and a relatively benign inflation environment.

“Seven-plus per cent growth is impressive, but sustaining it is a different challenge altogether,” said Soumya Kanti Ghosh, Group Chief Economic Adviser at State Bank of India. “The IMF’s medium-term projection reflects the reality that public investment cannot keep doing the heavy lifting indefinitely. The baton has to pass decisively to private capex and productivity-led growth.”

The global backdrop against which India’s upgrade has come is itself notable. The IMF expects world output to remain “resilient,” with global growth projected at 3.3 per cent in calendar year 2026 and 3.2 per cent in 2027, broadly unchanged from 2025.

These forecasts represent a small upward revision for 2026 compared to the October 2025 WEO, even as uncertainties around geopolitics, trade policy and financial conditions persist.

“This steady performance on the surface results from the balancing of divergent forces,” the IMF noted. Headwinds from shifting trade policies and geopolitical fragmentation are being offset by tailwinds from surging investment in technology, particularly artificial intelligence, as well as accommodative financial conditions and the adaptability of the private sector. North America and parts of Asia, including India, are expected to benefit disproportionately from these trends.

For India, the reference to technology-led investment is particularly significant. Economists argue that India’s growth prospects are increasingly tied not just to physical infrastructure, but also to digital public infrastructure, services exports and integration into global technology value chains.

“India is emerging as both a consumption story and a technology story,” said Radhika Rao, senior economist at DBS Bank. “That combination is what makes its growth relatively resilient even when global trade slows.”

Inflation dynamics also appear to be moving in India’s favour. The IMF expects inflation to return close to target levels after easing in 2025, aided by subdued food prices. The Reserve Bank of India’s inflation target is 4 per cent, and recent readings have given policymakers greater room to focus on supporting growth without compromising price stability.

According to a senior RBI official, the IMF’s assessment broadly aligns with the central bank’s internal outlook. “The disinflationary trend, particularly in food prices, has helped anchor expectations. This allows monetary policy to remain calibrated, supporting growth while remaining vigilant on risks,” the official said.

However, some economists caution against complacency. Rural demand, while improving, remains uneven, and employment-intensive growth continues to lag headline GDP numbers.

“The key question is not whether India can grow at 7 per cent but who benefits from that growth,” said Jayati Ghosh, professor of economics at the University of Massachusetts Amherst. “Without stronger job creation and income growth, sustaining consumption over the medium term will be difficult.”

The IMF’s revised forecast, then, offers both affirmation and warning. It confirms that India has navigated a turbulent global environment better than most peers, aided by policy stability and domestic demand. Yet it also highlights the need for structural reforms — ranging from labour and land to education and skills — to convert cyclical momentum into durable, inclusive growth.

As the global economy grapples with fragmentation and uncertainty, India’s relative strength stands out. But the IMF’s message is clear: the real test lies not in outperforming this year’s forecast, but in sustaining growth once the tailwinds fade.